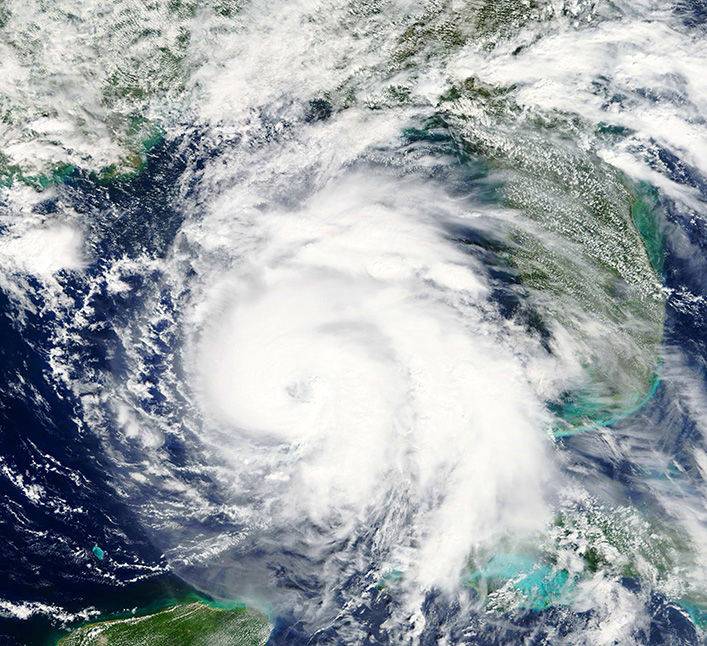

Hurricane Damage

Living in South Florida means that hurricanes are a fact of life. Every season we prepare for the worst and hope for the best. When disaster does strike, Insurance companies send out adjusters quickly and try to settle fast, to the relief of homeowners and business owners, except this isn’t always in the best interest of the policy holder.

For instance, you have damage to your roof, so the insurance company offers a quick payment that seems generous to fix the roof, but is it? If the roof leaked then you may have ceiling damage that may not be visible yet, insulation that may need to be replaced, and possible mold issues. Insurance companies are in the business of making money and not paying claims.

The Desir Law Firm solely represents policyholders. We specialize in assessing and filing hurricane damage insurance claims to get you the compensation you need and deserve. Should it become necessary, we will expertly negotiate a settlement or, if need be, aggressively litigate in court on behalf of our clients, throughout the State of Florida.

What is My Insurance Company’s Legal Responsibility When My Business Files a Hurricane Claim?

As a Florida business owner, having a business insurance policy is one way you ensure your company, assets and customers are protected during hurricane season. Your business and commercial insurance policies are there to ease the financial burden associated with lost revenue, repairs and replacement due to hurricane damage.

Your policy is a legally binding contract between you and your insurance company. If you’re unsure what your insurance company’s responsibility is regarding a hurricane damage claim, talk to Desir Law Firm.

Leonard Desir is able to take a complex insurance policy (which is a legal contract) and make it easy for a client to understand, and he examines the policy to see where their insurance company is violating its agreement. Whether you’re a homeowner or business owner, knowing Desir Law firm has helped hundreds of people, who have been taken advantage by their insurance companies when filing property damage claim is comforting.

How do I Know if I Need Help with a Hurricane Insurance or Business Interruption Claim?

In Florida, filing a hurricane insurance claim or a business interruption claim with your insurance company can be complex, confusing and frustrating. If you’re unsure what your insurance company’s responsibility is regarding a hurricane damage claim, talk to a professional who understands insurance law.

We would like to believe that insurance companies will step up to the plate and do the right thing, but insurance companies are in business to make money, not pay claims. Desir Law Firm will advise you on the best way to proceed. We routinely review consult, and, when necessary, litigate various types of insurance policy contracts on behalf of homeowners, renters, business and commercial property owners.

Public insurance adjusters and prominent law firms trust our experience and refer their clients to us for help with evaluating property damages and filing insurance claims. If you feel your property or business insurance claim is being ignored, unreasonably delayed or improperly handled, or if you feel your insurance claim has been unfairly denied,or the insurance company has acted in bad faith, youhave a right to legal recourse and/or legal redress.

Schedule a FREE Consultation with an Experienced Insurance Law Attorney Call 954-848-2912 Today!